PREVENT THIS: Payment Fraud

Digital wallets like Apple Pay and Google Pay are way safer than checks or cards. Only 3% of fraud attempts target mobile wallets, while 63% target checks. Is it time to upgrade to a digital wallet?

What’s Going On Here?

You’re buying coffee. Someone behind you is recording you with their smart glasses. They just saw your card number, expiration date, and the security code on the back. Now imagine you tapped your phone instead. What did they see? Nothing useful at all.

How we pay for things has changed a lot in the past ten years. Most people know that tapping your phone is faster than swiping a card. But here’s what many don’t realize: mobile payments were built to be safer, not just quicker.

Your physical credit card is basically a billboard for your financial information. That black stripe on the back holds your full card number in plain text. Any device that gets close enough can read it. Criminals have used this trick for years by installing “skimmers” on gas pumps and ATMs. These tiny devices copy your card info when you swipe. In 2025, the Secret Service partnered with local law enforcement organizations to investigate 60,000 card readers across the country. [Editor’s Note: The Secret Service has broad jurisdiction on finical fraud crimes. They were originally founded to combat counterfeiting during the civil war.] The devices they investigated would have stolen over $400 million if left in place.

But cards aren’t the only problem. Let’s talk about checks.

The Check Problem Nobody’s Talking About

You might think checks are old news. They’re not. About 33% of payments between businesses still happen by check. And 75% of companies have no plans to stop using them anytime soon. This creates a huge target for criminals.

Check fraud cost over $1.3 billion in 2023. Here’s how the scam works: Criminals steal checks from mailboxes. Then they use household chemicals like nail polish remover to erase the handwritten parts. The printed parts of the check stay the same. The criminal just writes in their own name and a new amount.

This is called “check washing,” and it works surprisingly well. Mail theft complaints doubled between 2023 and 2025.

There’s also “check cooking.” Criminals take photos of stolen checks and use editing software to create fake copies. One real check becomes a template for dozens of fakes. Each one goes to a different person for a different amount.

The Treasury Department found $688 million in suspicious check fraud in just the first six months of 2025. Every single state reported cases. And because banks process checks within a day or two, most victims don’t find out until it’s too late.

Why Your Phone is Actually Safer Than Your Wallet

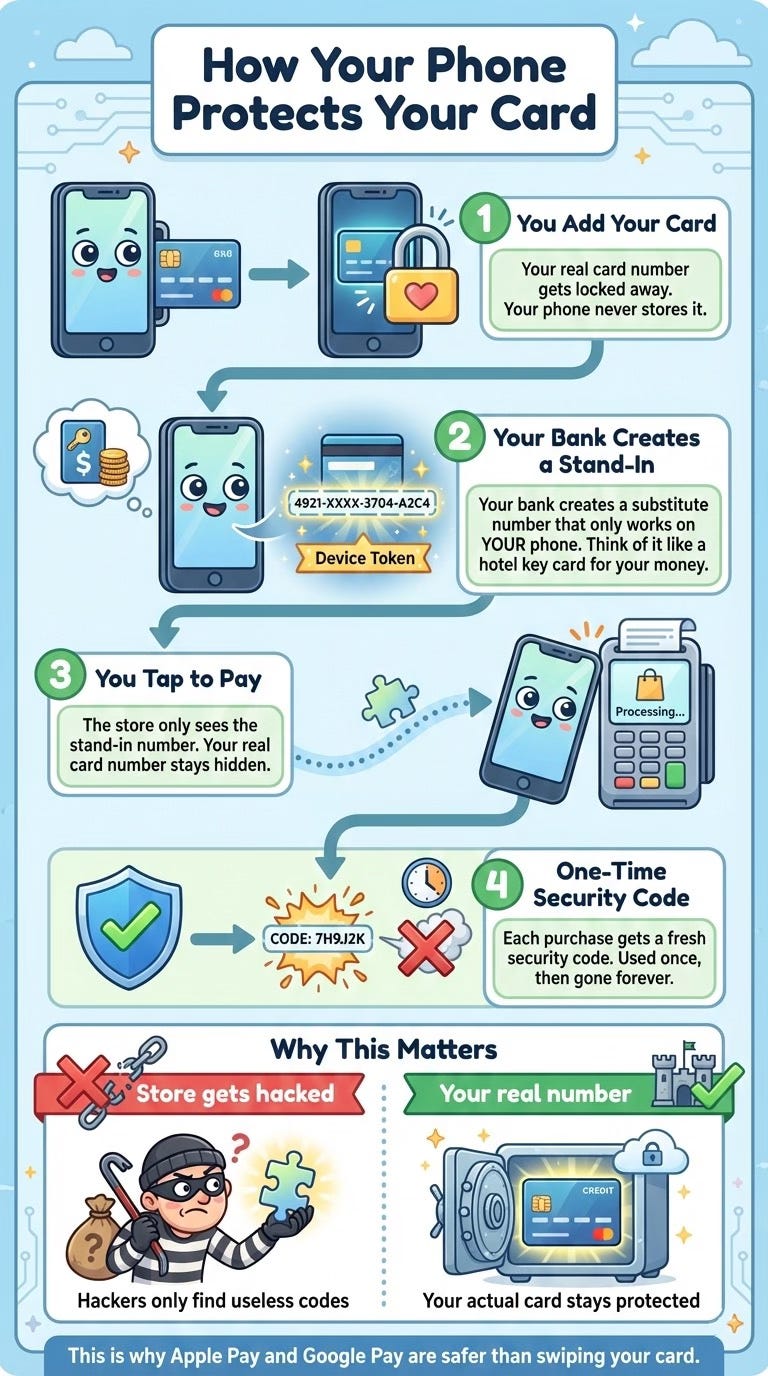

When you add a credit card to Apple Pay or Google Pay, something cool happens. Your real card number never gets saved on your phone. Instead, your bank creates a special code called a Device Account Number. This code only works on your specific phone.

Think of it like an arcade token. The token works inside the arcade, but it’s worthless at the grocery store. Your phone’s payment code works the same way. Even if a hacker stole the code during a purchase, they couldn’t use it anywhere else. It only works on your device for that one transaction.

It gets even better. Every time you buy something with Apple Pay, your phone creates a brand new security code just for that purchase. Regular credit cards use the same three-digit code on the back for every single transaction. Mobile wallets make a fresh code each time.

Here’s what makes mobile payments so secure:

Your real card number stays hidden. Stores never see it. If a store gets hacked, the attackers only find useless codes.

You have to prove it’s you. Every purchase needs Face ID, Touch ID, or your passcode. Someone who steals your phone can’t just tap it at a register.

Each device is separate. Using the same card on your phone and your watch creates two different codes. If someone steals your phone, your watch is still safe.

You can turn it off instantly. Lose your phone? Turn on Lost Mode, and Apple Pay stops working right away. Try doing that with the credit cards in your stolen wallet.

The Numbers Tell the Story

A 2025 survey found that 79% of companies dealt with payment fraud last year. But some payment methods got hit way harder than others:

Checks: 63% of fraud attempts

Mobile wallets: 3% of fraud attempts

Virtual cards: 5% of fraud attempts

Card skimming jumped 77% compared to the year before. Nearly 120,000 debit cards got compromised by skimmers in 2024. Three out of four skimming attacks happened at locations that had never been targeted before. Criminals keep finding new spots to plant their devices.

Meanwhile, fraud involving digital payments is expected to drop 40% as security technology improves. Fingerprint and face scanning alone should cut fraud by 30%.

What Happens When You Lose Your Phone vs. Your Wallet

Your wallet gets stolen: You have to call every card company one by one. Cancel each card. Wait for new ones in the mail. Update your card info everywhere you saved it. A fast thief could rack up charges before you even realize what happened.

Your phone gets stolen: You log into Find My from any computer. Turn on Lost Mode. Every payment card on your phone stops working instantly. No phone calls. No waiting. The thief has your device, but they can’t buy anything. They can’t get past Face ID, and even if they somehow did, the payment codes are already dead.

Apple has an extra feature called Stolen Device Protection. When your iPhone is somewhere unfamiliar, certain actions need Face ID with no backup option. Some changes make you wait an hour and scan your face again. This gives you time to lock down your phone before a thief can cause real damage.

What To Do If You Detect Fraud

If you spot a charge you didn’t make, act fast. Call your bank or card company right away. Most have 24/7 fraud hotlines, and the number is usually on the back of your card. Tell them which charges are fake. They’ll cancel your current card and send you a new one with a different number. You won’t be responsible for fraudulent charges if you report them quickly. Federal law limits your liability to $50 for credit cards, and most banks waive even that. For debit cards, reporting within two days limits your loss to $50, but waiting longer can cost you more.

After you call, check your other accounts too. Criminals who steal one card number sometimes have more of your information. Look at your bank statements and credit report for anything strange. Change your passwords if you used the same one in multiple places. If the fraud came from a data breach or your wallet was stolen, consider placing a fraud alert on your credit report. This makes it harder for someone to open new accounts in your name. You can do this for free by contacting any of the three credit bureaus: Equifax, Experian, or TransUnion.

The Bottom Line: Upgrade How You Pay

The evidence is clear. Digital payments with tokenization are much safer than physical cards, checks, or cash. Every time you swipe a magnetic stripe instead of tapping your phone, you’re using old technology with old risks.

Here’s what to do:

For everyday purchases: Use Apple Pay, Google Pay, or Samsung Pay when you can. Look for the tap-to-pay symbol at checkout.

For monthly bills: Set up digital wallet payments where you can. Your streaming services will use secure codes instead of storing your real card number.

For checks: Avoid mailing checks if possible. If you must write one, use a gel ink pen. Brands like Uni-ball make “fraud proof” pens that resist washing. Never leave outgoing checks in your home mailbox. Drop them at the post office.

For your physical cards: If a store’s tap-to-pay isn’t working, be careful. Hacked payment terminals often force you to swipe instead. Find another place to pay if something feels wrong.

Credit vs. debit: Use credit cards over debit when you can. Credit cards have better fraud protection, and fixing problems is usually easier.

You don’t need to be paranoid about payments. You just need to know that your phone offers better security than the cards in your wallet. And using it takes nothing more than a tap.

Sources: FBI IC3 2024 Report, FinCEN Check Fraud Analysis, FICO Card Compromise Studies, AFP 2025 Survey, Apple Pay Security Docs, Secret Service 2025 Skimming Report